It’s not something anyone likes to think about, but estate and succession planning is essential if you want to ensure your family and business partners are protected when you’re no longer around.

At Merthyr Law, we make sure we understand your unique set of circumstances so we can offer expert advice and structure your affairs to keep your assets in the right hands.

Our Family Safe® Program ensures we regularly review your estate planning. As a result, we stay on top of any changes in your personal circumstances and make the necessary adjustments when there are changes in the law.

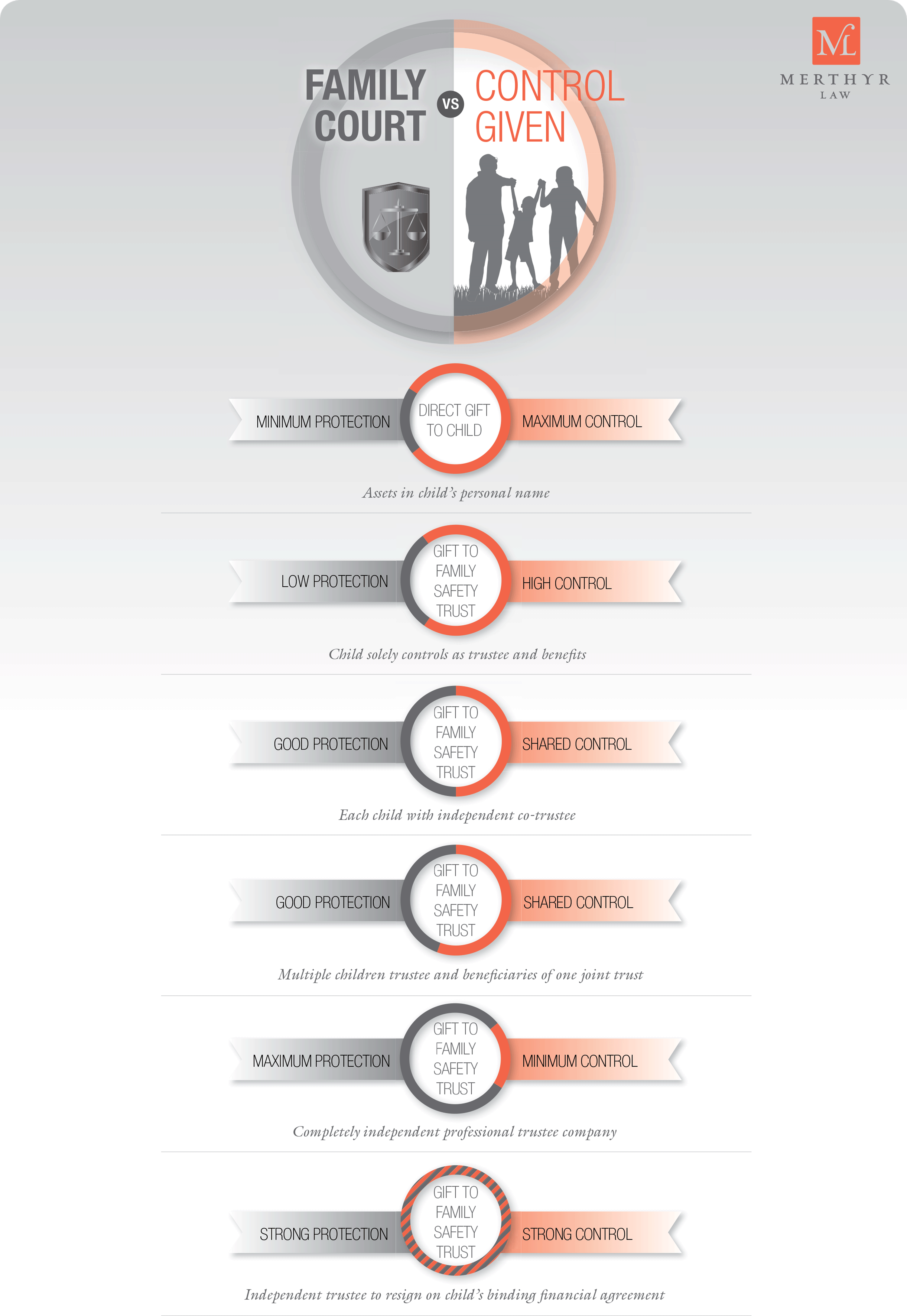

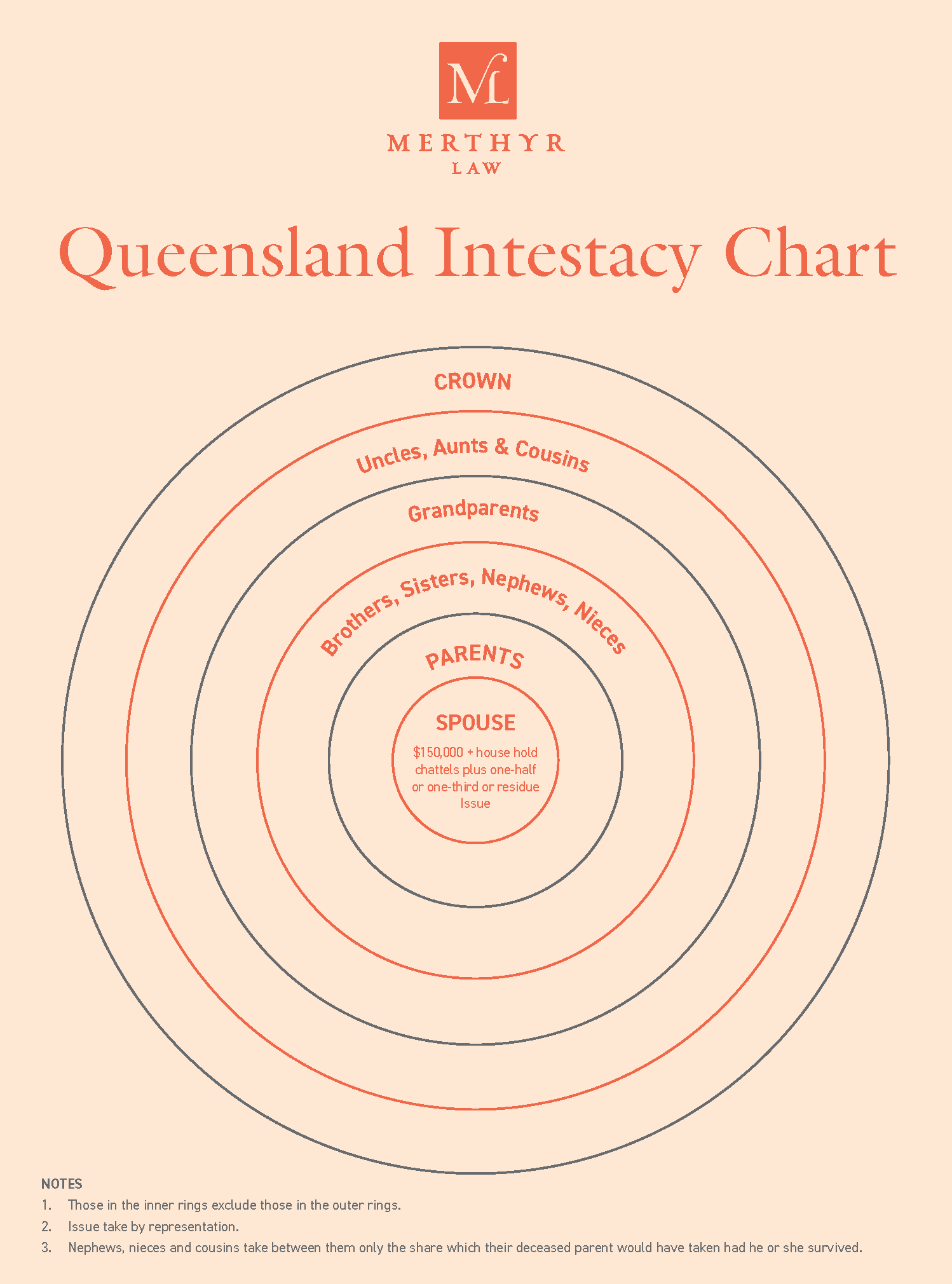

You owe it to your loved ones to keep your Family Safe by investing in an effective estate and succession plan rather than leaving them with your mess to sort out. And by making a clear plan, you can also protect your assets against attack from the family court or bankruptcy.

In addition, estate and succession planning effectively limits potential disputes among beneficiaries, helping to keep family feuds at bay.